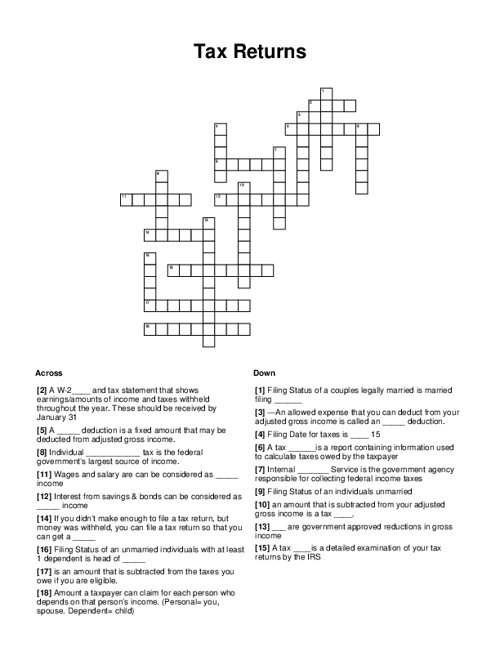

Tax Returns Crossword Puzzle

QUESTIONS LIST: income: individual _ tax is the federal government’s largest source of income, revenue: internal _ service is the government agency responsible for collecting federal income taxes, return: a tax _ is a report containing information used to calculate taxes owed by the taxpayer, refund: if you didn’t make enough to file a tax return, but money was withheld, you can file a tax return so that you can get a _ , april: filing date for taxes is _ 15, single: filing status of an individuals unmarried, jointly: filing status of a couples legally married is married filing _ , household: filing status of an unmarried individuals with at least 1 dependent is head of _ , form: a w-2 _ and tax statement that shows earnings/amounts of income and taxes withheld throughout the year. these should be received by january 31 , earned: wages and salary are can be considered as _ income, unearned: interest from savings & bonds can be considered as _ income, adjustments: _ are government approved reductions in gross income , deduction: an amount that is subtracted from your adjusted gross income is a tax _ , itemized: —an allowed expense that you can deduct from your adjusted gross income is called an _ deduction, standard: a _ deduction is a fixed amount that may be deducted from adjusted gross income, exemption: amount a taxpayer can claim for each person who depends on that person’s income. (personal= you, spouse. dependent= child), tax credit: is an amount that is subtracted from the taxes you owe if you are eligible. , audit: a tax _ is a detailed examination of your tax returns by the irs