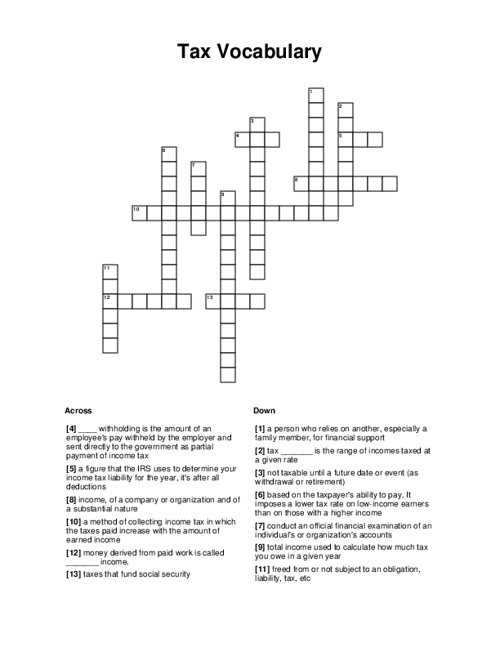

Tax Vocabulary Crossword Puzzle

QUESTIONS LIST: audit: conduct an official financial examination of an individual's or organization's accounts, tax: _ withholding is the amount of an employee's pay withheld by the employer and sent directly to the government as partial payment of income tax, earned: money derived from paid work is called _ income, revenue: income, of a company or organization and of a substantial nature, bracket: tax _ is the range of incomes taxed at a given rate, exempt: freed from or not subject to an obligation, liability, tax, etc, dependent: a person who relies on another, especially a family member, for financial support, progressive: based on the taxpayer's ability to pay. it imposes a lower tax rate on low-income earners than on those with a higher income, agi: a figure that the irs uses to determine your income tax liability for the year, it's after all deductions, tax deferred: not taxable until a future date or event (as withdrawal or retirement), taxable income: total income used to calculate how much tax you owe in a given year, vertical equity: a method of collecting income tax in which the taxes paid increase with the amount of earned income, fica: taxes that fund social security